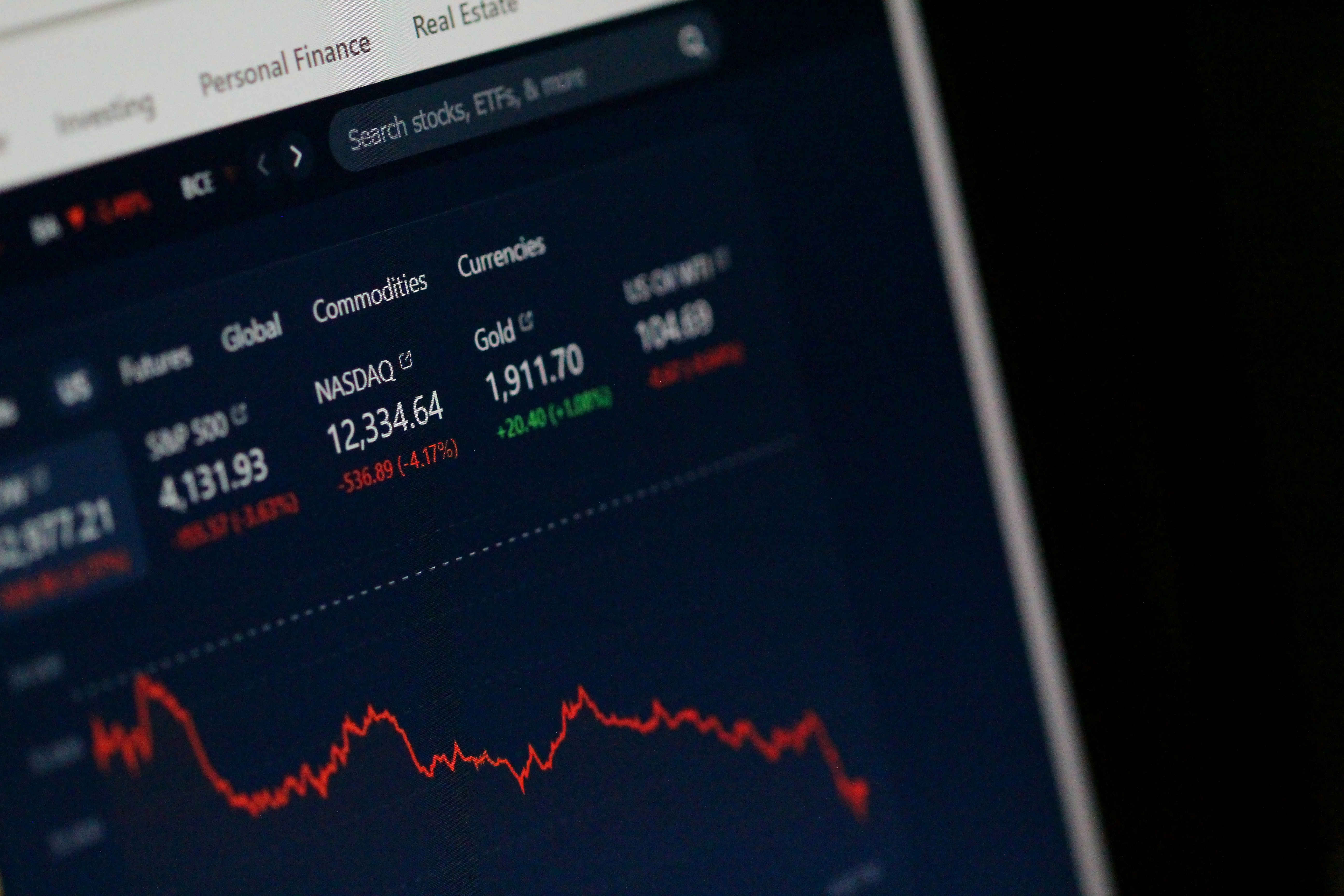

The sharp fall of Indonesia’s stock market in late January 2026 was widely a@ributed to global sentiment shifts and technical adjustments related to MSCI indices. Yet, to treat the episode as a transient confidence shock misses its deeper significance.

What unfolded was a stress test of Indonesia’s capital market architecture. It reveals longstanding structural weaknesses that have existed for years but only become visible under pressure. The episode reminds us that market volatility is often less about news and sentiments, but more about structure.

Despite its growing size, Indonesia’s capital market remains economically shallow. With more than 900 listed companies, millions of retail investors, and a fast-growing asset management 2 industry, Indonesia appears to embody financial deepening. In reality, however, liquidity, price discovery, and risk absorption remain highly concentrated.